Five global shifts to watch in 2026: elections, alliances, and new fault lines

By Emily Carter | September 12, 2025

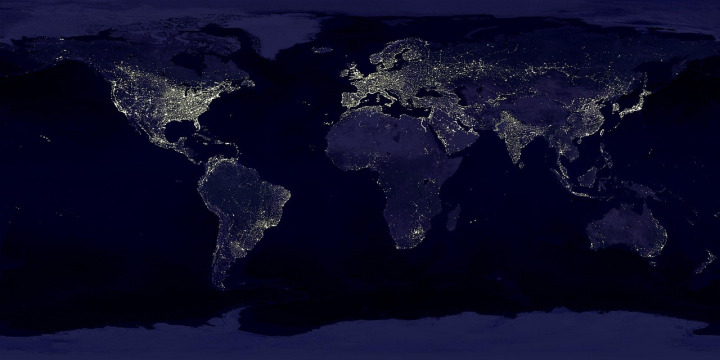

From ballot boxes to boardrooms and border crossings, 2026 is shaping up to be a year of inflection points. Major elections, shifting security partnerships, a turbulent energy transition, fast-moving AI rules, and climate-driven migration pressures will test governments and markets alike. Here are five dynamics likely to define the global agenda—and what to watch next.

Shifting alliances on display as world leaders convene at a high-stakes summit.

1) A high-stakes election year

Dozens of countries are expected to head to the polls, and even where votes aren’t scheduled, local and regional contests will shape national narratives. The issues cutting across borders are familiar—cost of living, jobs, migration, security—but local contexts will drive distinct outcomes. Turnout patterns among younger voters and first-time voters could be decisive, particularly where social platforms and short-form video continue to set the tone of political debate.

What to watch: Fragmented legislatures may complicate coalition-building, extending policy uncertainty. Markets will parse fiscal promises for signals on taxes, spending, and debt trajectories. Internationally, leadership changes can redirect stances on trade, climate, and defense burden-sharing with immediate ripple effects.

2) Realigning security blocs

The global security architecture remains under strain as regional conflicts persist and defense spending rises. Expect more minilateral arrangements—targeted, purpose-built partnerships on technology, intelligence, critical infrastructure, and maritime security—complementing, and at times complicating, traditional alliances. Defense supply chains, from semiconductors to artillery components, continue to be re-routed as countries prioritize resilience over efficiency.

What to watch: Joint exercises and defense industrial agreements are bellwethers of deeper alignment. Port access rights, overflight permissions, and satellite cooperation deals offer early clues to where influence is expanding. The balance between deterrence and diplomacy will shape energy flows and trade corridors.

3) Energy transition meets commodity volatility

Clean-energy deployment is accelerating, yet the path remains uneven. Grid bottlenecks, permitting timelines, and financing costs are friction points, even as battery costs trend lower and utility-scale storage scales up. Meanwhile, fossil fuel dynamics still matter: price swings tied to geopolitics or extreme weather can reset inflation expectations and stress import-dependent economies. Critical minerals—lithium, nickel, copper, and rare earths—are a strategic chessboard as countries compete for upstream access and downstream processing.

What to watch: Auction results for renewables, grid-connection backlogs, and corporate power-purchase agreements (PPAs) signal momentum. Policy incentives and industrial policies will influence where manufacturing capacity lands. Keep an eye on mineral refining capacity outside traditional hubs and on recycling as a second supply source.

Wind and solar expansion accelerates as grids and permitting race to keep up.

4) Rules for AI and digital competition

Artificial intelligence is moving from concept to deployment across sectors—customer service, logistics, finance, health research, and creative work. The regulatory landscape, however, remains a moving target. Governments are advancing frameworks around model transparency, safety evaluations, data provenance, and liability. Cross-border data flows, cybersecurity standards, digital competition policy, and content authentication will all shape how and where AI is built and used.

What to watch: Implementation details matter more than headline rules. Certification regimes, risk-tier classifications, and enforcement capacity will determine real-world impact. For businesses, compliance roadmaps and vendor risk assessments become core strategy. For consumers, expect clearer disclosures around AI-generated content and tools to verify authenticity.

5) Migration, climate stress, and urban resilience

Climate variability—heatwaves, floods, droughts, and storms—continues to interact with food prices, water security, and livelihoods. Urban areas face rising costs to upgrade infrastructure: cooling, drainage, transit, and coastal defenses. Migration remains a pressure valve and a political flashpoint. Cities that combine realistic housing policy, targeted social services, and workforce integration stand to benefit economically, but the politics are complex.

What to watch: Insurance availability and pricing are leading indicators of physical-risk exposure. Bond markets are watching resilience investments and fiscal buffers. On the ground, emergency response capabilities, early-warning systems, and cross-jurisdictional planning will separate the cities that cope from those that fall behind.

Urban flooding underscores the rising costs of climate resilience and adaptation.

Markets and business implications

Financing costs: Interest-rate paths remain pivotal for capital-intensive sectors—grids, renewables, data centers, and advanced manufacturing. Even modest rate moves can shift project pipelines.

Supply chains: “China+1” and “friend-shoring” strategies continue, but success hinges on logistics capacity, skills availability, and grid reliability in destination markets.

Corporate disclosures: Climate, cybersecurity, and AI-governance reporting are converging into mainstream investor expectations, raising the bar for board oversight and internal controls.

Talent: Skills in power engineering, AI safety, cybersecurity, and compliance are in short supply; expect competition for specialized talent and reskilling initiatives at scale.

Society and media dynamics

Information ecosystems will be stress-tested by election cycles and fast-evolving generative tools. Expect more investment in provenance technologies (content credentials, watermarking) and newsroom standards for AI-assisted workflows. Media literacy campaigns and platform policies will shape how effectively false claims are countered without curbing legitimate speech.

The bottom line

2026 is less about a single shock than a series of interlocking shifts. The countries and companies that fare best will be those that stay pragmatic: diversifying supply chains without sacrificing efficiency, investing in resilience and skills, and engaging in clear, credible communication with citizens and stakeholders.

More World: breaking developments and on-the-ground reporting.